Mortgagee sale listings could hit new record in 2020

By Colliers International

/ EdgeProp Singapore |

Ask Buddy

Listings for industrial property

Past Industrial rental transactions

Price trend for industrial property sales

Compare price trend of Commercial vs Industrial properties

Past Industrial sale transactions

Listings for industrial property

Past Industrial rental transactions

Price trend for industrial property sales

Compare price trend of Commercial vs Industrial properties

Past Industrial sale transactions

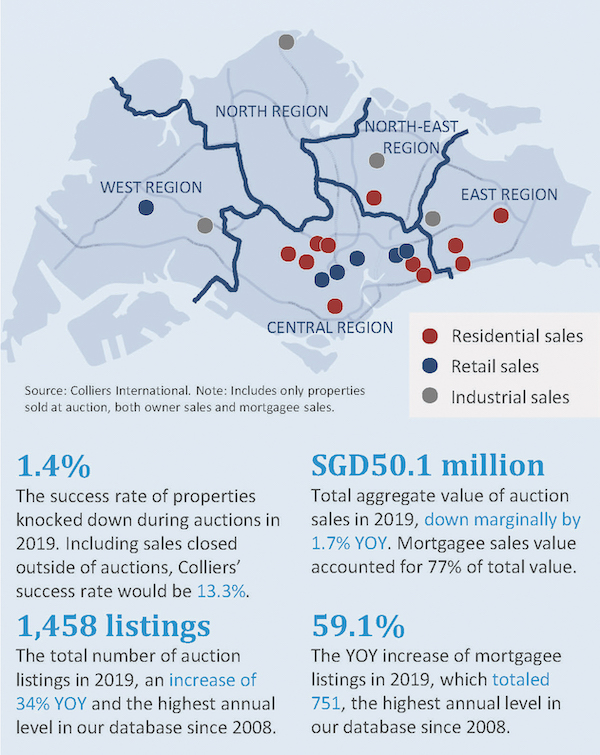

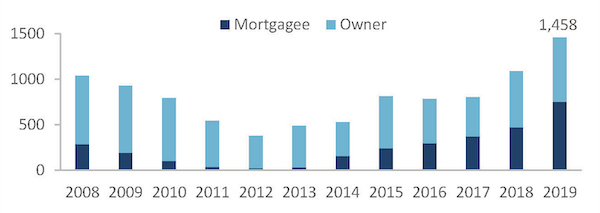

SINGAPORE (EDGEPROP) - A larger number of properties were put up for multiple rounds of auction last year, compared to 2018. The total number of listings (and relistings) across all sectors and all major auction houses totalled 1,458 in 2019. This is a 34% jump y-o-y compared to 1,088 the previous year, according to Colliers International in its March 20 research report.

Residential listings continued to account for the lion’s share of total auction listings in 2019 (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The higher number of properties listed as mortgagee sales (foreclosed properties) also increased, reflecting the challenging economic outlook in 2019. “We expect increased distressed or mortgagee sales in the retail, industrial and residential sectors from the ongoing Covid-19 outbreak, especially if it precipitates a downturn into 2H2020,” says Tricia Song, Colliers International director and head of research for Singapore. “We also expect prices to be more realistic, leading to an improved success rate.”

Faced with a depressed rental market and the dampening effects of the July 2018 cooling measures, the residential sector continued to lead both auction listings and sales in 2019. Listings of residential properties increased 54.1% y-o-y to 798 units and retail listings rose 21.8% y-o-y. Meanwhile, industrial listings were up 10.5% y-o-y to 306 and office properties 17.1% higher at 48 units.

Advertisement

In total, 11 non-landed residential units, nine strata-titled industrial and retail units and one shophouse were sold during auctions in 2019, Colliers says.

Residential still the lion’s share

Residential listings continued to account for the lion’s share of total auction listings in 2019 at 54.7%, up from 47.6% in 2018. The number of mortgagee sales surged 59.1% to 751 listings in 2019, with residential properties accounting for 432 (57.5%), up 67.3% from the previous year.

Colliers attributes the higher rate of mortgagee sales to an increase in mortgage payments owing to rising interest rates during the 2015 to 2019 period, coupled with a subdued residential rental market. Personal circumstances such as loss of job or bankruptcy could also have led to higher defaults.

“Subsequent to the cooling measures in July 2018, we think possibly more distressed owners were unable to dispose of properties quickly enough, leading to defaults,” says Colliers’ Song.

Retail mortgagee listings saw a 72.7% increase y-o-y to 114. Many of these were small units in strata-titled malls or locations with low foot traffic. The difficulty in finding tenants or sustainable rents in such properties left owners unable to support mortgage payments, hence the spike in mortgagee listings. Industrial mortgagee listings rose by 29.5% y-o-y to 189 while office mortgagee listings surged by eight times y-o-y to 16.

Number of auction listings by type of seller

Source: Colliers International

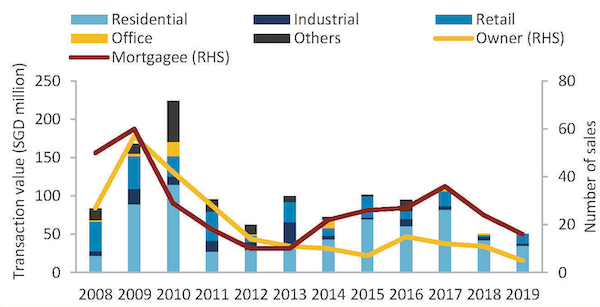

Fewer units sold under the hammer

The total number of properties sold at auctions in 2019 continued to drop to 21 properties from 35 properties the previous year. This reflects a 40% decline y-o-y, Colliers’ observes. With the number of listings rising, success rate therefore more than halved to 1.4% in 2019 from 3.2% in 2018, which was also the lowest annual level in Colliers’ database.

Advertisement

This rate, however, does not take into account properties sold before or after the auctions. Colliers’ auctions indicated that the success rate — including sales during and outside of Colliers’ auctions — was much higher at 13.3% in 2019 (excluding re-listings).

Of the 21 properties sold under the hammer last year, 16 (or 76.2%) were mortgagee sales. Of the 16, eight were residential properties, four were industrial and four were retail properties.

Knocked-down auction sales by sector and type of seller

Source: Colliers International

Mortgagee sales value 25.3% higher y-o-y in 2019

Despite the lower number of sales in 2019, total aggregate value of properties sold at auctions remained relatively stable at $50.1 million. This is a marginal decline of 1.7% y-o-y, due to the higher quantum per unit transacted in 2019.

Despite the fewer number of properties sold at auctions, the total mortgagee sales value actually increased 25.3% y-o-y to $38.5 million as the average ticket size in 2019 was almost double that of 2018.

The mortgagee sales value accounted for 76.8% of total auction sales value, up from 60.3% in 2018. The residential sector accounted for the lion’s share at 79.2% of total mortgagee sales value, up from 73.4% in 2018.

In the first two months of 2020, there were 208 property listings at auctions and one sale. This is in line with the trend in 2019. “We expect listings to grow 10% in 2020 as more properties are put up for sale amid an uncertain environment,” says Song.

Advertisement

Source: Colliers International

Read also:

Ask Buddy

Listings for industrial property

Past Industrial rental transactions

Price trend for industrial property sales

Compare price trend of Commercial vs Industrial properties

Past Industrial sale transactions

Listings for industrial property

Past Industrial rental transactions

Price trend for industrial property sales

Compare price trend of Commercial vs Industrial properties

Past Industrial sale transactions

https://www.edgeprop.sg/property-news/mortgagee-sale-listings-could-hit-new-record-2020

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles