Manufacturing tops resilience and rebound ranking: Colliers

By Valerie Kor

/ EdgeProp Singapore |

Ask Buddy

Price trend for commercial property sales

Past Commercial rental transactions

Past Commercial sale transactions

Compare price trend of Commercial vs Industrial properties

Listings for commercial property

Price trend for commercial property sales

Past Commercial rental transactions

Past Commercial sale transactions

Compare price trend of Commercial vs Industrial properties

Listings for commercial property

SINGAPORE (EDGEPROP) - The top three sectors that hold the greatest “resilience and rebound potential” amid the Covid-19 pandemic are manufacturing, technology and hospitality, according to the Resilience and Rebound Ranking Report by Colliers International.

The report identifies the most resilient industries over past crises, and the opportunities for commercial real estate sectors beyond the current Covid-19 outbreak.

Using historical GDP performance, stock index returns as well as future earnings growth as key metrics, the report measures each sector’s resilience during the Asian Financial Crisis in 1997, SARS in 2013, and Global Financial Crisis from 2007 to 2008, and subsequent rebound post-crisis.

Advertisement

Colliers notes that although the manufacturing sector is facing labour shortages due to stringent travel restrictions, it will rebound quickly as Singapore lifts “circuit breaker” measures in phases, which might see the economy opening up towards the end of June.

The technology sector is ranked second by Colliers, having topped the high stock index returns and earnings outlook rankings.

It is followed by the hospitality sector, which has been hard-hit by the lack of tourists in the last two months. However, “a strong rebound is expected to follow”, says Colliers.

Changes in real estate demand

The pandemic has necessitated telecommuting and spurred online shopping and delivery, which will have implications for real estate demand moving forward.

Judging by the experience of the last couple of months, working from home is now a real possibility for a large part of the workforce. Jerome Wright, senior director of capital markets and investment services at Colliers, says that flexibility in workplaces presents strong growth for “fringe office spaces” that are out of town and more cost-effective.

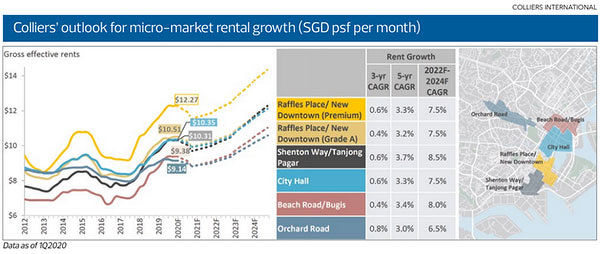

However, the technology sector will continue to drive Grade-A office demand as it is expected to be the fastest-growing sector over the next three years based on earnings growth. Colliers expects that CBD Grade-A office rents will rebound 2.6% in 2021 after a 5% decline in 2020.

Advertisement

Tricia Song, head of research for Singapore at Colliers International, believes that office occupiers should reassess their workspace needs after “embracing technology and flexible work strategies”. Also, wellness certifications and property management capabilities will become key criteria for building decisions post-pandemic.

In tandem with the growing e-commerce industry, there will be high demand for better logistics, delivery services, and data broadband. As such, Song recommends that investors focus on prime offices and industrial buildings, such as high-specification space and business parks.

The manufacturing sector should also embrace automation, artificial intelligence and Internet of Things to improve productivity and space efficiency. Warehouse owners can look into improving inventory and last-mile management processes.

In addition, the Colliers report is optimistic that tourist arrivals will rebound once the pandemic subsides, based on historical data. As such, hotels and tourism-related businesses such as attractions will likely remain resilient. Hotels can adopt technology further, such as using facial recognition check-in, as well as facilitating customer service and housekeeping with robots.

Song also believes that retail malls could provide near-term opportunities. However, the report acknowledges three structural challenges for the retail industry, especially for the brick-and-mortar segment: increasing e-commerce, high occupancy costs and product competitiveness. Online sales as a percentage of retail sales jumped from 7.4% in February 2020 to 8.5% in the following month, and this is likely to increase further. Thus, even with the limited new supply of retail space, average rents are expected to decline 5% this year and stay flat in 2021.

Read also:

Advertisement

Ask Buddy

Price trend for commercial property sales

Past Commercial rental transactions

Past Commercial sale transactions

Compare price trend of Commercial vs Industrial properties

Listings for commercial property

Price trend for commercial property sales

Past Commercial rental transactions

Past Commercial sale transactions

Compare price trend of Commercial vs Industrial properties

Listings for commercial property

https://www.edgeprop.sg/property-news/manufacturing-tops-resilience-and-rebound-ranking-colliers

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles