How can property loans help SMEs in a recession?

By Paul Ho

/ iCompareLoan.com, The Edge Property |

Singapore has narrowly averted a technical recession. While that has been averted, the PMI is below 50%, indicating a contraction in the manufacturing sector.

Another measure of recession that some economists suggest is not to simply look at GDP figures (demand), but to look at falling income levels, as well as rising unemployment rate. Many enterprises can sustain a short-term drop in demand and may not immediately retrench people, therefore, leaving the purchasing power largely intact.

Singapore’s small and medium-sized enterprises (SMEs) make up 99% of all enterprises, employ 66% of the workforce and account for 48% of the GDP. SMEs are defined as enterprises that have revenues of fewer than $100 million and less than 200 employees. A drop in demand means that companies are hardly growing their top lines and may go into the red. This is especially true for SMEs with less than $10 million in revenue.

Advertisement

Singapore quarterly GDP growth rate

Source: TradingEconomics, SingStats

Singapore’s corporate default rate of corporations listed on the Singapore Exchange is below 2%. SMEs could see a higher default rate of 3% to 4%.

In 2008, access to capital and funding by Singapore’s SMEs was constricted. This led the government to “enhance the various government schemes that are in place to help our small and medium-sized enterprises retain access to credit. Most of these schemes involve government risk-sharing with the banks on loans to SMEs”.

In short, this means that the banks cut back on SME lending exposure owing to potential higher non-performing loan risks. Therefore, funds will likely dry up during uncertain financial periods when SMEs will need them most. It is safe to say that SMEs will be exposed to elevated funding disruption risks and increased cost of funding during recessionary periods. So, SMEs need to take action now to secure funding.

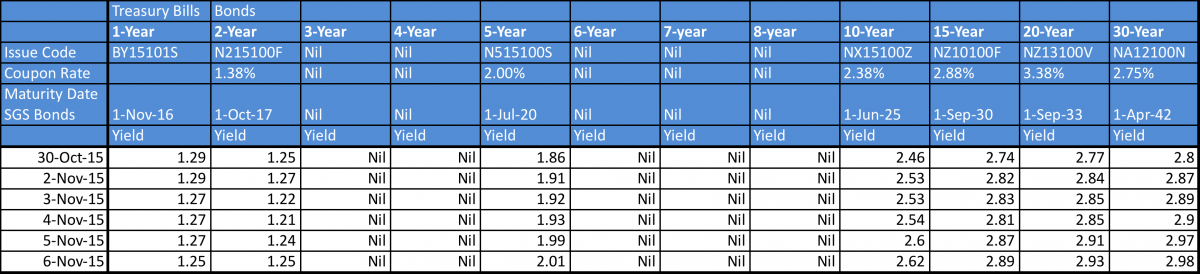

Future interest rate trends: Looking at the bond yield curve

The bond yield curve gradient has become less steep, indicating slower growth. There are also higher mid- and long-term interest rate expectations indicating inflation expectations or simply a higher interest rate environment. The 20-year bond is currently at 2.9%.

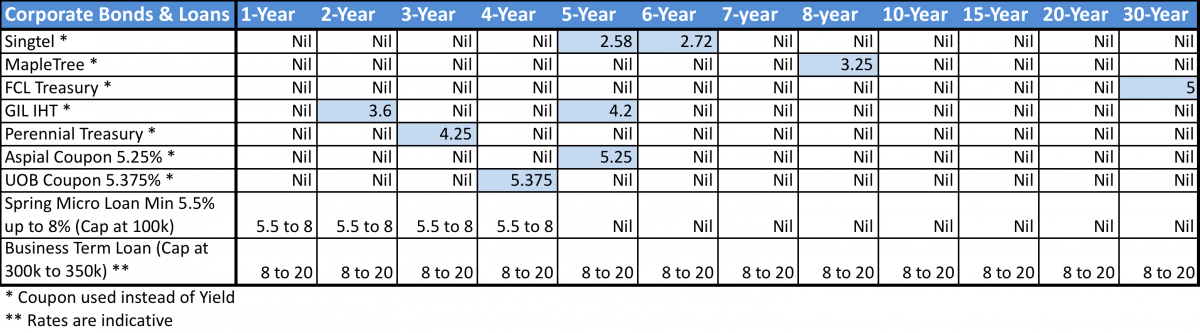

Outstanding corporate bonds in Singapore by listed companies are estimated at $128 billion. Recent 1Q2015 bond issuers such as Singapore Telecommunications (Singtel) has 5.5-year and 6.5-year coupons of 2.58% and 2.72% respectively, while Mapletree Commercial Trust’s eight-year bond has a coupon of 3.25%. UOB’s bond with maturity at Sept 3, 2019 gives a coupon of 5.375%.

As there is a credit spread between risk-free rate (government bonds) versus the corporates, the interest rates and borrowing cost reflect that risk. SMEs will have an even bigger credit spread versus the risk-free rate, hence the unsecured business term loan rates are usually in the over-10% range, depending on loan size as well as tenure.

Advertisement

Singapore bond yield curve end-2014 versus November 2015

Source: Asian Development Bank

Hierarchy of borrowing costs: Secured versus unsecured loan

The impending weakness in economic growth poses more risks to SMEs than to large corporations. However the level of financial literacy in SMEs, especially the smaller ones, is usually not so strong, such that SMEs usually end up with a higher cost of funds structure.

Secured lending refers to lending in which an asset is pledged. (For example, at the pawnshop, you pledge your watch, which is worth $10,000 and the shop will lend you $6,000, at 1% interest a month.) Secured lending presents less risk to the lender and therefore charges lower interest rates.

Unsecured lending does not require pledged assets. This presents greater risk to lenders and, therefore, is more expensive. Businesses have underutilised secured loans as small businesses usually have nothing to secure against.

There are many types of secured and unsecured loans. A secured loan is the cheapest form of borrowing. However, many businesses use the most expensive type of borrowing, equity, followed by factoring (invoice discounting), then business term loan and line of credit.

The Micro Loan Programme by SPRING Singapore is also a good source of funding, but not many companies qualify for it. Those who do may not be able to obtain the maximum $100,000 loan. Interest cost for the MLP starts from 5.5%, with up to four years’ tenure. Many SMEs are owned by families or husband-and-wife teams that have been in operation for many years and exceed the less-than-three-years-old eligibility ruling.

Table 1: Singapore Government Securities Benchmark Yield

Source: Asian Development Bank

Table 2: Singapore Corporate bonds and business term loan rates

Source: ADB, Spring, iCompareLoan.com

Problems faced by SMEs

Wrong corporate structure

Many SMEs may not have the right financing or salary structure. These bosses tend to under-declare their incomes and instead, declare dividends. While this reduces their taxable income, the new total debt servicing ratio (TDSR) ruling also impedes many SME bosses from buying their own homes. Low incomes may also limit the amount of funds they can borrow despite the positive cash flow from their business.

Advertisement

Squeezed gross margins

Many businesses have gross margins that are already squeezed, having to compete against China, India and newer economies. In its 2015 financial report, Singtel reported operating revenues of $17,222.9 million, while earnings after operating expenses (before tax, interest and amortisation) are $5,090.7 million. This indicates an EBITDA [earnings before interest, taxes, depreciation] and amortisation margin of about 29.6%. To put it bluntly, this is a company that is either a tripoly or duopoly in the various business segments it competes in, and has substantial pricing power. This is a very good result. But how many SMEs can aspire to this kind of results?

Faced with borrowing costs in the mid-10%, labour costs that take up 5% to 10% of revenue, and operating costs which could take up another 5% to 15% of revenue, these businesses need a gross margin in excess of 30% just to break even. Not many industries can offer gross margins in excess of that figure. Therefore, SMEs are especially sensitive to top-line growth for those with over 20% to 40% gross margins. This means that a drop in demand hurts them more than an increase in cost. Those SMEs with gross margins of less than 10% are especially susceptible to increases in fixed costs as they are unlikely to be able to raise prices.

Rising cost of funds

Cost of funds is expected to rise, if you interpret the spot yield curve rates. Underlying influence may be owing to the impending US Federal Reserve funds’ target rate hike as unemployment in the US, as at October, is 5%. With market uncertainty, access to funds for SMEs could be even more restricted in the next one to two years.

How can SMEs overcome the high cost of funding issues?

SME bosses should start to realise that underdeclaration of income impedes borrowing and start to rectify this situation to reflect their true income. While it is important to have a tax efficient salary structure using a combination of salary, director fees and dividends, it is worth reviewing this to be eligible for adequate funding.

Business gross margins are largely determined by the level of competition in established business sectors. In short, the largest determinants of whether an SME will make money are labour, rentals and cost of funds. If you are Singtel or Capital Mall, you have access to cheap capital at 2.5% to 3.5% and you can select an industry segment with a reasonable gross margin and make money, whilst SMEs choosing the same industry may not.

But SMEs, especially those whose directors are currently in their late 30s and early 40s and have bought their own residential properties, could be sitting on tied-up equity in their properties. Residential home loan rates are around 2%. They could free up this capital and invest prudently in their own business. With this reduced cost of funding, the business owners could immediately save about 10% off borrowing costs.

Case study: SME owned by two directors and three shareholders

Why would I borrow on my residential home for a company which I am only one of the many directors?

Example: Two directors owned 35% of the business each, with three shareholders each holding 10%.

Funds needed: $500,000 (for business expansion)

We advised the firm to structure a director’s resolution to approve the company to request a director’s loan to the company at 5% interest rate. The two major shareholders cum directors hold 70% of the shares, and are allotted $350,000. Shareholders or directors who do not wish to lend to the company at the approved 5% interest rate may give up their allotment. Unused allotment may be used by other directors/shareholders equally.

These two major shareholders recently took out loan to refinance their residential property with cash out (equity term loan) of $400,000 at 1.8%. They then lent their company $400,000 at 5% interest, making a decent return on their loan to their own company. Another two shareholder took up their allotment and lent the company $100,000 at 5%. In this way, the company has access to cheaper capital, boosting its survival and yet creating a fair debt structure for all directors and/or shareholders. It is similar to some kind of preferential bonds that only directors and shareholders can participate in.

Summary

SMEs can get their personal income structure right with the optimal balance of tax efficiency as well as sufficient income for borrowing capacity.

Business niches are increasingly hard to find; most businesses do not find a “blue ocean” strategy to execute. In the interim, they are confined by the Red Ocean and are squeezed at the top-line pricing (margins squeezed) and bottom line (rising fixed costs). The major cost factors are labour and rental. SMEs that are thinking to expand are faced with cost of funds, labour and rental costs.

SME directors should leverage on their cheaper secured mortgages to free up equity from their housing loan to lower their business borrowing costs by structuring a director’s loan to the company.

For innovative and growing companies, investors with at least $300,000 of spare cash could get in on the game (to bridge the gap behind by banks) to lend to growing companies that can afford to pay 14 to 18% per annum in interest costs. Default rates are carefully managed using some of the same tools used by the banks and credit processes to assess risks.

Even if default rates are double that of large companies that is still less than 4%. We could structure some convertible loans where investors can partake in the upside should the company get bought over, while drawing a net return of 10% to 14% per annum.

Paul Ho is founder and chief mortgage consultant of iCompareLoan.com. He can be contacted at paul@icompareloan.com.

https://www.edgeprop.sg/property-news/how-can-property-loans-help-smes-recession

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles