Horizon Towers tries again

By Cecilia Chow

/ EdgeProp Singapore |

Ask Buddy

Condo projects with most unprofitable transactions

Most unprofitable landed transactions in past 1 year

Condo projects with most expensive average PSF

Landed transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Condo projects with most unprofitable transactions

Most unprofitable landed transactions in past 1 year

Condo projects with most expensive average PSF

Landed transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Its collective sale attempt, if successful, could spur more developments in prime Districts 9 and 10 to jump on the bandwagon

Some of the owners at Horizon Towers on Leonie Hill Road are giving a collective sale another shot 11 years after their first attempt was aborted. “The en bloc attempt by the owners of units at Horizon Towers will be closely watched, particularly since it comes on the back of a fairly successful launch of New Futura nearby,” says Lee Liat Yeang, senior partner of legal firm Dentons Rodyk & Davidson.

The collective sale of Horizon Towers (centre), flanked on either side by Leonie Towers, is now underway (Credit: Samuel Isaac Chua/EdgeProp Singapore)

New Futura, a newly completed 124-unit freehold condominium by listed property giant City Developments (CDL), held its preview on Jan 18. In the first preview weekend, 24 of 30 units released were sold at an average price of $3,200 psf, according to CDL.

Advertisement

Incidentally, New Futura is a redevelopment of the former freehold Futura condo that CDL purchased en bloc for $287.3 million, or $1,179 psf per plot ratio (ppr), in October 2006.

In the first weekend of its private preview, 24 units at New Futura were sold at an average price of $3,200 psf (Credit: Samuel Isaac Chua/EdgeProp Singapore)

Adjacent to Horizon Towers is OUE Twin Peaks. Completed in 2015, all 462 units in the 36-storey twin-tower development have been sold. Based on caveats lodged so far, the average price achieved at the 99-year leasehold condo is $2,714 psf. Developer OUE had introduced an innovative deferred payment scheme two years ago to move sales. Its success subsequently spawned many variations of the scheme by other developers of completed, high-end condos with unsold inventory.

OUE Twin Peaks is a redevelopment of the former Grangeford Apartment that was purchased by OUE in August 2007 at the height of the last collective sale boom. The price for the site was $625 million, or $1,820 psf ppr.

Developer OUE had introduced an innovative deferred payment scheme two years ago to move sales. Its success subsequently spawned many variations of the scheme by other developers of completed, high-end condos with unsold inventory. (Credit: Samuel Isaac Chua/EdgeProp Singapore)

Second time the charm?

In the event that Horizon Towers succeeds in its collective sale attempt, the new project is likely to be priced at around $2,800 psf, given that the site is 99-year leasehold, reckons Suzie Mok, senior director of investment sales at Savills Singapore. The price is a slight discount to the $3,200 psf at New Futura, given that the latter is freehold.

The process of getting owners’ consent at the 210-unit private condo on Leonie Hill Road began in December. So far, more than 50% of the owners have signed on the dotted line. There is a little way to go before it achieves the 80% consensus required for the site to be launched for collective sale.

Horizon Towers was completed in 1984, but it sits on a 99-year leasehold site with the lease starting from 1979. Therefore, it has a remaining lease of 60 years. Buyers of projects with 60 or fewer years left on their leases tend to face additional financing restrictions, which limits the pool of buyers, say property agents. This in turn will have an impact on the resale prices of units in the development.

Advertisement

The latest transaction at Horizon Towers was for a 2,583 sq ft, four-bedroom unit on the eighth floor that changed hands for $2.98 million ($1,154 psf) last October. The half a dozen resales done in the development last year were in the range of $991 to $1,154 psf, according to caveats lodged with URA Realis. In 2016, units had changed hands at $956 to $1,085 psf.

Some buyers see Horizon Towers’ resale prices as “a bargain” compared with other newer developments in the same neighbourhood. Typical units at the project are also large, with three-bedroom units starting from 2,303 sq ft and four-bedroom units from 2,583 sq ft.

New condos in the Leonie Hill-Grange Road neighbourhood (Credit: Samuel Isaac Chua/EdgepProp Singapore)

'Value for money'

“At around $1,000 psf, it offers value for money,” says the owner of a four-bedroom unit at Horizon Towers. “It’s hard to find a replacement unit at such prices in prime District 9.” He is not in favour of the collective sale, as he purchased his unit two years ago and renovated it for his own use. If the collective sale goes through, he will have to pay seller’s stamp duty (SSD).

A Singaporean, he said he had looked at many private condos before deciding to buy a unit at Horizon Towers. His parents have lived in Horizon Towers for more than 10 years and he lived with them before he purchased his own unit when he got married and started a family.

Horizon Towers’ first collective sale attempt was in early 2007, when it was on the brink of being sold to a consortium led by Hotel Properties. The price then was $500 million, or close to $850 psf ppr. A protracted dispute ensued between minority owners and the members of the collective sale committee at both the Strata Board and High Court level before the case went to the Court of Appeal, which resulted in the deal being overturned in 2009. A number of minority owners then took the chairman and a member of the collective sale committee to court over costs and expenses incurred during the dispute, and the case was finally settled in the High Court in October 2013.

Dentons’ Lee is not surprised that owners of Horizon Towers are revisiting a collective sale. “Almost the whole of Singapore is going up for en bloc sale,” he says. This time around, the collective sale committee has appointed JLL as its property consultant. “JLL is one of the leading property consultants for collective sales and they should be able to guide the owners on the right track to success,” says Lee. Since the start of 2017, JLL has done more about $2.2 billion worth of en bloc deals.

Advertisement

En bloc fever in L:eonie Hill

Horizon Towers is not the only development that is attempting a collective sale in the Leonie Hill neighbourhood. Adjacent to Horizon Towers is the 138-unit Leonie Gardens, which fronts Leonie Hill. About 70% of the owners at Leonie Gardens support the collective sale, according to Michael Tan, one of the members of the collective sale committee. It is the owners’ first collective sale attempt.

So far, about 70% of the owners at Leonie Gardens have agreed to a collective sale (Credit: Samuel Isaac Chua/EdgeProp Singapore)

With its fire hydrant-red exterior and location on the highest point of Leonie Hill, Leonie Gardens is the most prominent condo in the prime neighbourhood. Completed in 1993, the 99-year leasehold condo still has 71 years left on its lease (the lease runs from 1990). Located across the road from Leonie Gardens is Leonie Towers. Completed in 1976, the twin 25-storey condo contains just 92 units, which are mainly four-bedroom units of 2,907 to 3,251 sq ft.

“Owners are motivated to attempt a collective sale if they feel that they will be getting a good premium on the resale price,” says Sieow Teak Hwa, managing director of Teak Hwa Realty, a firm he founded 18 years ago that specialises in en bloc sales. “After all, an en bloc sale is about unlocking the value of your property. Another motivation is that as a condo gets older, maintenance issues start to surface. Owners of 99-year leasehold properties also realise that the value of their property erodes over time. That is why you see quite a number of private condos and privatised HUDC estates attempting an en bloc sale again and again.”

Teak Hwa Realty was the marketing agent for Vista Park on South Buona Vista Road, which was sold en bloc to Oxley Holdings in December at $418 million. This was 19.4% above its guide price of $350 million and 29.4% higher than its reserve price of $323 million. Including a differential premium of $72 million for topping up the 99-year lease, Oxley’s purchase price translates into $1,096 psf ppr.

Meanwhile, owners of units at Vista Park are expecting a payout ranging from $1.39 million to $4.18 million. “Owners at Vista Park are getting up to double what they would have received if they were to sell their units individually,” says Sieow.

Nine shophouses at the junction of Changi Road and Telok Kurau that were sold to Macly Capital for $35.5 million in a deal brokered by Teak Hwa Realty Estate (Credit: Teak Hwa Reaty)

Prime district sites to headline en bloc deals in 2018

The most recent en bloc deal done by Teak Hwa Realty was the sale of nine shophouses at the junction of Changi Road and Telok Kurau on Jan 23. The buyer was privately held property developer Macly Capital, which paid $35.5 million ($733.8 psf ppr) for the freehold site. The shophouses can be redeveloped into a five-storey project with about 40 residential units and six to eight commercial units on the ground floor, according to Sieow.

En bloc deals transacted over the past year have been at premiums ranging from 40% to 100% of the last transacted market price, says Ian Loh, Knight Frank Singapore executive director and head of investment and capital markets.

Tan Hong Boon, JLL regional director of capital markets, has noticed a shift in the market. “It started with the sites in the suburbs and moved to the city-fringe areas such as East Coast and Pasir Panjang, and now to the prime districts,” he adds. Besides Horizon Towers, JLL is also the marketing agent for Gilstead Court, Landmark Tower on Chin Swee Road, Flynn Park at Pasir Panjang and King’s Mansion on Tanjong Katong Road.

Savills Singapore’s Mok is of the view that the price gap in sites in the prestigious areas of Districts 9 and 10 relative to those in the outlying areas has narrowed. For instance, Allgreen Properties paid $477.94 million ($1,960 psf ppr) for Royalville on Bukit Timah Road and $181 million ($1,840 psf ppr) for Crystal Tower on Ewe Boon Road. This translates into selling prices of $2,800 to $2,900 psf for the new development at the Royalville site, and $2,650 to $2,800 psf for the Crystal Tower site.

“If these en bloc sites on Bukit Timah and Ewe Boon Road can achieve prices close to $2,000 psf ppr, why can’t an en bloc site in the prime Cairnhill area be sold at prices above $2,000 psf ppr?” says Mok.

Trendale Tower on Cairnhill Road is attempting a collective sale, with Savills Singapore as its property consultant (Credit: Samuel Isaac Chua.EdgeProp Singapore)

Towards end-2017, Allgreen paid $552.86 million ($1,540 psf ppr) for the Fourth Avenue Government Land Sales (GLS) site in prime District 10, while Frasers Centrepoint won the Jiak Kim Street site fronting the Singapore River in prime District 9 with a bid of $955.4 million ($1,733 psf ppr).

GLS sites 'the barometer'

All eyes will now be on two other prime GLS sites whose tenders are closing on Jan 30: the mixed-use development site on Holland Road in Holland Village and the residential development site on Handy Road, near Plaza Singapura and the Dhoby Ghaut MRT interchange station.

Last October, the government also released a residential development site on Cuscaden Road for sale on the Reserve List. The 99-year leasehold site, which can yield about 170 condo units, is located next to Regent Hotel.

“The barometer for the residential market has always been the bid prices achieved at GLS sites,” says Savills Singapore’s Mok. “If the GLS sites on Handy Road and Cuscaden Road receive strong bids, then the en bloc sites in the prime districts will really take off.”

The 20-unit The Wilshire is on the market for $98.07 million or $1,525 psf ppr (Credit: Savills Singapore)

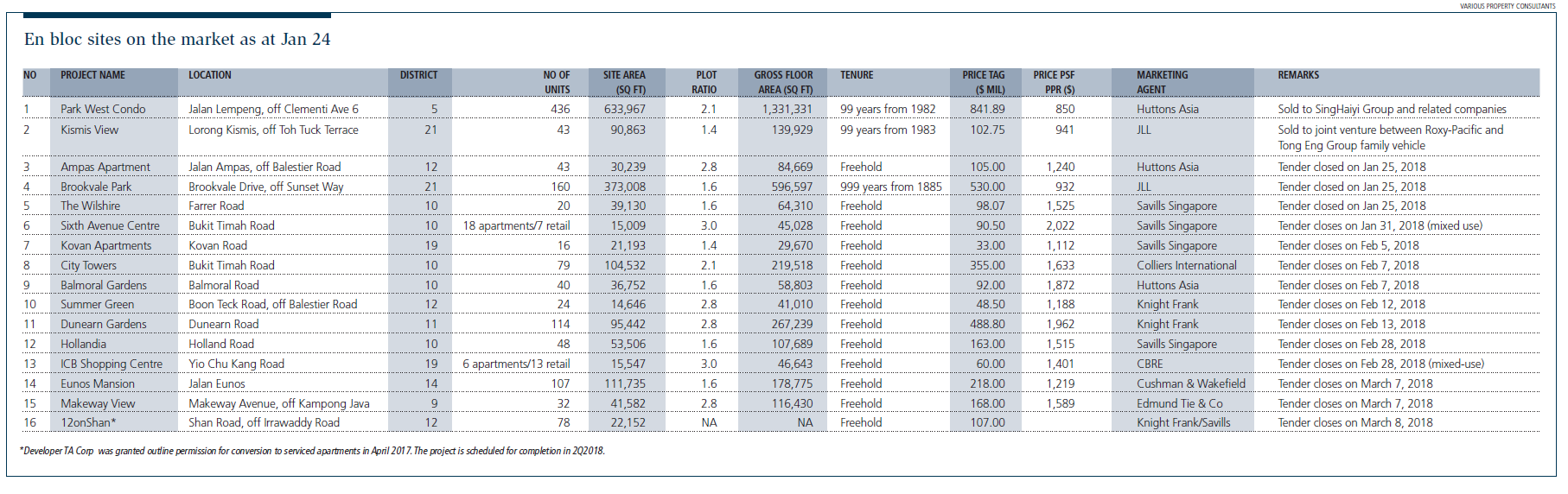

Mok is handling the collective sale of The Wilshire on Farrer Road, which was launched for sale on Dec 29 (the tender closed on Jan 25); as well as Hollandia for $163.5 million ($1,515 psf ppr) and Sixth Avenue Centre, a mixed-use development tagged at $90.5 million ($2,022 psf ppr) with commercial and residential components which were launched for sale at the beginning of the year.

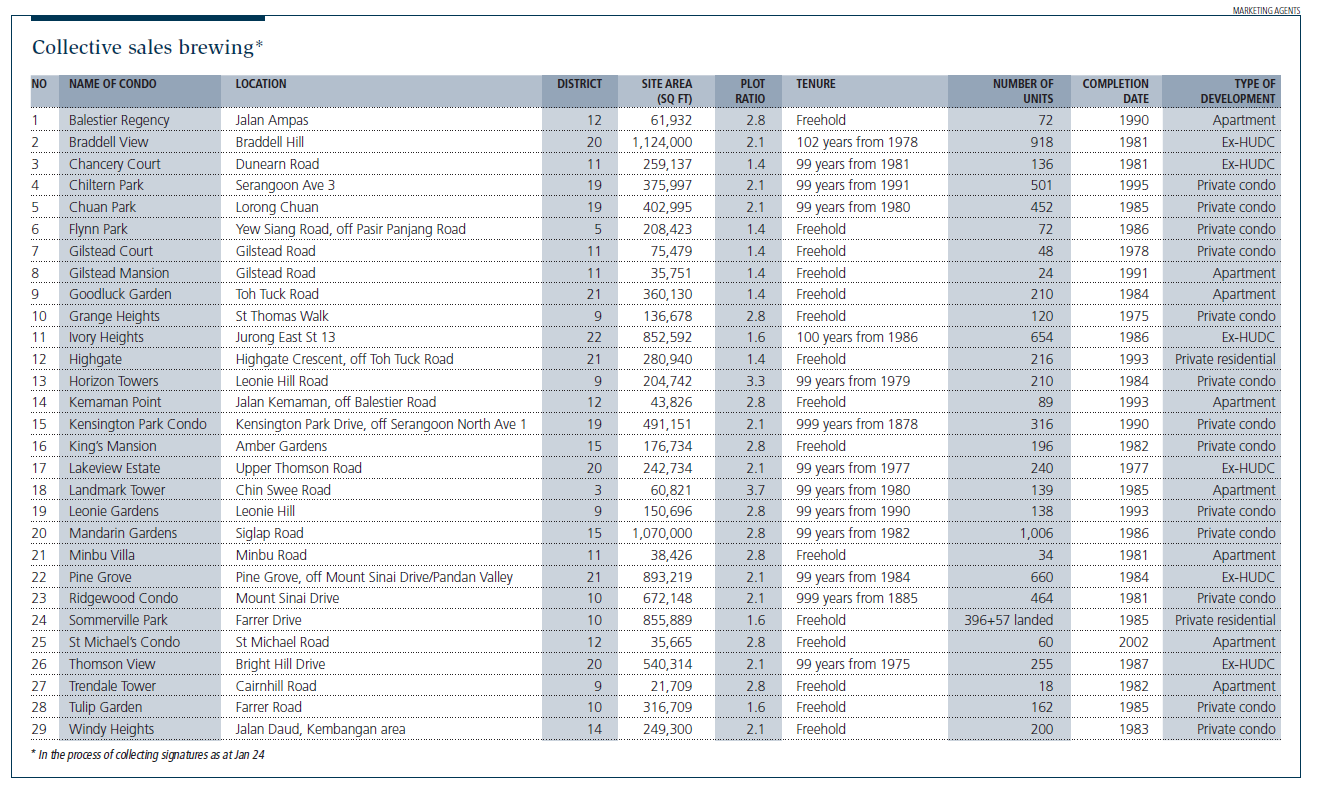

Sixteen en bloc sites have been launched for sale since the start of the year. Of these, seven are in the prime districts (including the three marketed by Savills). The other three are Makeway View in Newton, which was launched for sale at $168 million ($1,589 psf ppr); Balmoral Gardens, on the market with a price tag of $92 million ($1,872 psf ppr) and marketed by Huttons Asia; as well as Dunearn Gardens, which has an asking price of $489 million ($1,962 psf ppr) and Knight Frank as the marketing agent (see table).

Smaller deal sizes, more choice sites

Mok sees more sites in the prime districts being put up for en bloc sale this year. “The sites in the prime districts tend to be smaller, so the deal size may be smaller than those for the privatised HUDC estates and suburban condos in the outlying areas,” she says. “However, with more sites being launched for sale, the total sales value in 2018 could still match or even surpass last year’s level.” For the whole of 2017, a total of 33 en bloc sites worth $8.63 billion were sold.

However, she feels there is still room for price growth in the prime districts. Located in the prime Orchard Boulevard neighbourhood is the 77-unit 3 Orchard-by-the-Park, which is already completed. The project is a redevelopment of the former Westwood Apartments by YTL Singapore, which purchased the site en bloc in December 2007 for $435 million ($2,525 psf ppr). Savills Singapore brokered the sale. The price is still a record in terms of psf ppr price, surpassed only by the sale of the 12-unit Hampton Court on Draycott Park to Hong Kong’s Swire Group for $155 million ($2,526 psf ppr) at end-2012.

If Horizon Towers is successful in its latest collective sale attempt, it will certainly spur the collective sales of more choice sites in prime districts 9 and 10, says Dentons’ Lee. Developers could start replenishing their inventory of luxury projects in anticipation of the market upswing and the return of foreigners and high networth investors.

Ask Buddy

Condo projects with most unprofitable transactions

Most unprofitable landed transactions in past 1 year

Condo projects with most expensive average PSF

Landed transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Condo projects with most unprofitable transactions

Most unprofitable landed transactions in past 1 year

Condo projects with most expensive average PSF

Landed transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

https://www.edgeprop.sg/property-news/horizon-towers-tries-again

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles