Guangzhou R&F sells London's Vauxhall Square at 42% discount to valuation, posting an 'unheard of' loss in desperate move to pare debt

By Sandi Li

/ SCMP |

An undated concept of Guangzhou R&F’s Vauxhall Square development in London. (Photo: Allies & Morrison)

SINGAPORE (EDGEPROP) - Guangzhou R&F Properties has agreed to sell a plot of mixed-use land in London at a loss to Far East Consortium International, in a move that underscores its haste to raise cash to pare its debts.

The Vauxhall Square parcel in Vauxhall has been sold for GBP95.7 million ($170.8 million), at a discount of about 42% to market valuation, R&F said in a statement to the Hong Kong stock exchange. The parcel, which can yield 1.43 million sq ft of gross floor space, is designated for residential, hotel and hostel, office, retail and leisure developments, R&F said.

The sale is "one of the biggest losses I have ever heard," which is surprising because "London's property, particular those for commercial use, are [highly] sought after by investors as there is limited supply in prime areas," said Martin Wong, director of research and consultancy for Greater China at Knight Frank.

Advertisement

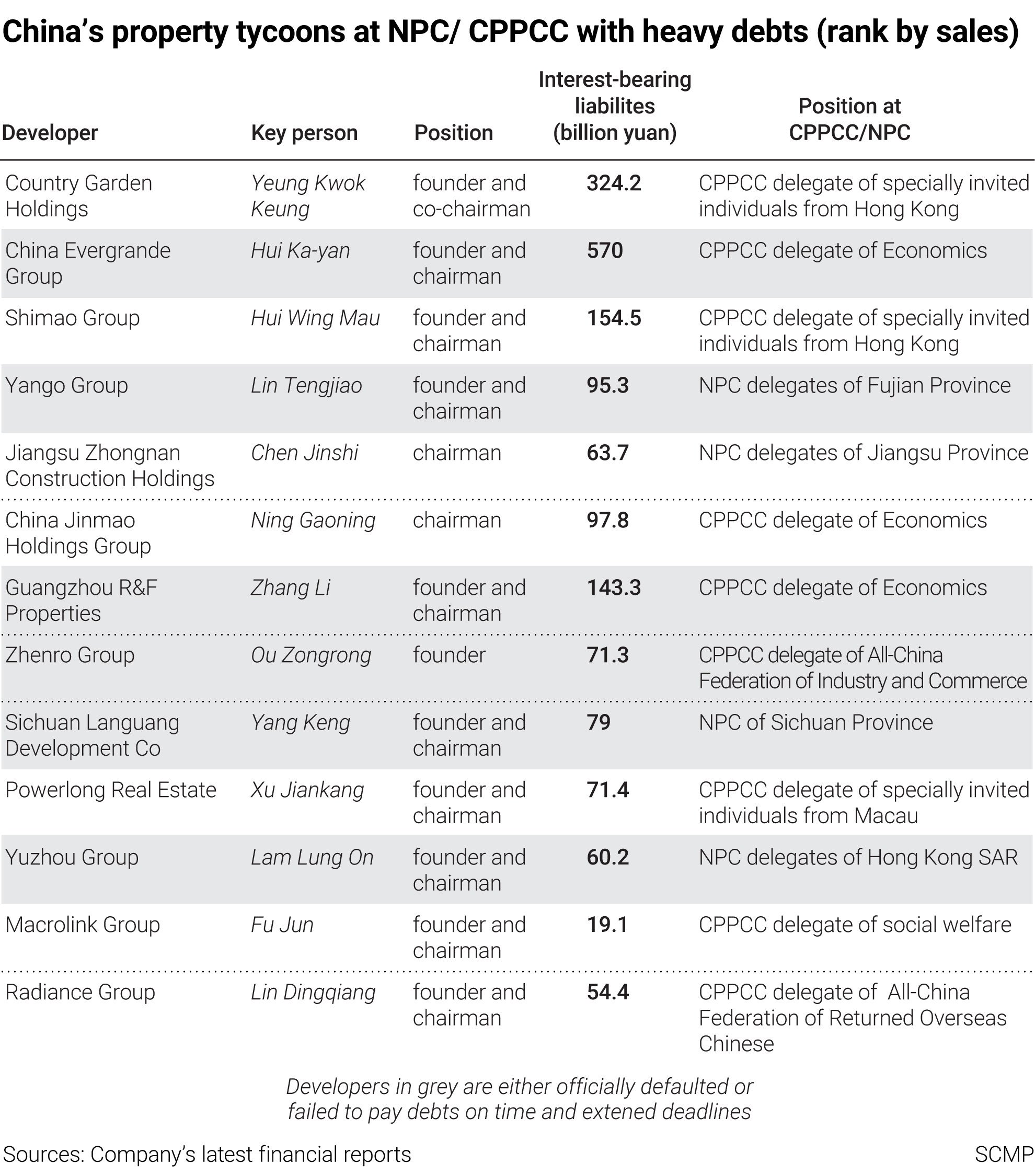

The desperate sale underscores how China's biggest debtors are stripping assets to reduce their gearing, as 2022 promises to be another record year for debt defaults, particularly among the highly leveraged property developers. R&F has RMB331.8 billion ($70.6 billion) of total liabilities, compared with RMB270 billion of saleable resources and a nationwide pipeline of properties to be launched, according to its 2021 interim report.

Source: SCMP

R&F will sell Vauxhall Square for a nominal GBP1, transferring GBP95.7 million of its intercompany debt to Far East, according to the terms of their agreement. R&F has a six-month option to repurchase the project from Far East for GBP106.6 million, according to the terms.

R&F will incur a loss of GBP68.8 million from its disposal, the company said. The loss drew a sharp contrast with CK Asset Holdings, one of the two flagship companies of Hong Kong's richest man Li Ka-shing, affectionately dubbed "Superman" for his deal-making prowess. CK Asset last week sold a prime office block at 5 Broadgate in London, where the London office of the Swiss bank UBS is located, for GBP1.2 billion, reporting a profit of GBP108 million since its 2018 purchase.

An undated concept of Guangzhou R&F's Vauxhall Square development in London. Photo: Allies & Morrison. alt=An undated concept of Guangzhou R&F's Vauxhall Square development in London. Photo: Allies & Morrison.>

The disposal by the Guangzhou-based R&F may be an "individual" case that doesn't reflect the overall market condition, since mainland Chinese developers are facing mounting pressure to reduce their debt under the government's "three red lines" debt limits, Wong said.

Vauxhall Square lies on the southern banks of the River Thames, not far from MI5's iconic headquarters building. An early proposal showed two tower blocks of 49-storeys each, according to information compiled by the skyscraper.com website. Construction has not commenced on the site, R&F said in its statement.

"The disposal is beneficial to the group in optimising the allocation of resources, increasing its capital reserve and reducing its gearing ratio, which is conducive to its ability to reduce risks and achieve long-term stable and healthy development," R&F's chairman Li Sze Lim said in the company's statement.

Advertisement

China's 100 largest property developers sold 40% fewer homes in January and February. R&F's property sales plunged 55% to RMB9.11 billion during the two months.

A man dressed as Santa Claus poses on a pod of the London Eye to mark the start of the festive season on 9 December 2020. Photo: PA Wire/dpa

R&F continues to face liquidity challenges as a large amount of short-term debt matures in 2022, while its access to funding could remain limited, Fitch Ratings said. Chinese developers face US$33 billion ($44.7 billion) of offshore capital-market maturities and RMB150 billion of onshore capital-market maturities from March to December this year, according to the credit rating agency.

"The company is planning asset sales to refinance the upcoming maturities, but we believe there is high execution risk due to the challenging macroeconomic environment," said Fitch.

The company sold 30% of the Guangzhou International Airport R&F Integrated Logistics Park for RMB7.3 billion last December to shore up its cash flow and cut debt.

R&F is not the sole developer offering fire sales. Soho China offered to dispose of 32,000 sqm of its property portfolios in Shanghai and Beijing at a 30% discount, East Money Information reported last week, citing chairman Pan Shiyi in a presentation to investors.

"All the proceeds will be used to cut debt," Pan said, according to the financial news portal. To speed up the sales, Soho China offered to increase the sales commission to 4% of the transaction value, he added.

Advertisement

Soho China had RMB18.5 billion of total debt as of June 30, including RMB1.2 billion due within 12 months and another RMB1.6 billion by June 2023. Its net gearing ratio stood at 43%

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2022 South China Morning Post Publishers Ltd. All rights reserved. Copyright (c) 2022. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/guangzhou-rf-sells-londons-vauxhall-square-42-cent-discount-valuation-posting-unheard-loss-desperate

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles