Fret not about house price increases and debts

By Alan Cheong

/ Savills, The Edge Property |

One of the concerns about the private residential property market is that rapid price increases are inducing households to chase after the market and, in doing so, take on further debt. The procurement of more debt is part of the reason for the rapid growth in housing loans in Singapore, bringing with it a fear that a fallout in the residential market would affect the quality of financial institutions’ loan books. Also, the rapid growth in housing loans is deemed a misallocation of debt from more productive activities. This article looks at several issues related to housing loans. One is whether the focus on house prices as a primary source of that increase is justified. Second, can we have house price increases and still stay on course with a measured increase of housing loans over time? Finally, we look at what measures are the least risky to reconfigure. By risk, we mean a higher chance of a resurgence of asset price inflation and rapid housing (or mortgage) loan growth.

Indeed, the year-on-year increase of housing loans has been astronomical, averaging 11.8% since the late 2002. Volatility has been tremendous, too. Looking at this, many will jump to the conclusion that much of this increase is due to asset price inflation (see Chart 1). Is that really the case? The chart shows that while housing loans have increased dramatically, the average price rise per annum, as captured by the Urban Redevelopment Authority’s (URA) All Private Residential Property Price (including EC) Index, has been growing at a much lower 5% a year. So, where did that excess growth of 6.8% a year come from? Volume increases is one — this has averaged 3.4% since 2002 as statistics are available only from then. Another is the likelihood that there has been a long-term rise in loan-to-value (LTV) ratios and other factors (see Chart 2).

Unfortunately, if we consider the dynamics of housing loans — such as how loans for projects under development are progressively disbursed, or loans that get repaid when the life of the mortgage expires, or when one sells a property or takes on a fresh property loan in the resale market — parsing the price increase to various attributing factors gets complicated. This means we cannot just use these statistics without subjecting them to modifications. As the housing and bridging loan numbers that are published by the Monetary Authority of Singapore are net cumulative loans (they include loans that have been retired or reduced), we will somehow have to arrive at the gross new loans drawn down each year. Using URA’s Realis database on the total value of transactions in the market each year, the change in the value of transactions can be used as a proxy for other the gross level of loans taken up. However, it is still not that untangled after accounting for that because the total value of transactions includes primary sale units — although these have been concluded, their loans have yet to be fully drawn down, and we have to account for this. Our growth attribution numbers are just an estimate, but this should not detract us from the general picture that emerges.

Advertisement

For 2003 to 2015, the estimated average annual gross housing loan (note that we have now weeded out bridging loans) growth is 18.8%, much higher than the 11.8% cumulative housing and bridging loans growth that official data shows. Once we have the gross growth rate, we are now ready to break down the sources of growth.

By reclassifying housing loan growth as a measure comprising several components, we can analyse more clearly. Here, we must stress that the various attributes shown in different colours are not necessarily independent. It would have been nice to have a chart with graded colour changes, as each component can be correlated to another or overlapping. With this in mind, we can start asking whether concerns raised by academia and policymakers on the rapid growth in household indebtedness, a large part of which has been caused by housing loan growth, is being properly addressed by the various cooling measures and the Total Debt Servicing Ratio (TDSR) framework. Also, with the price component of housing loan growth factored out, we can ask whether a continuation of price suppression measures or the desire to see further price correction is justified.

From Chart 2, it is clear that for the period under review, one of the significant components of housing loan growth is Primary Sale Volume increases. This contributed about 3.9% to housing loan growth. As much of the land supplied for additional private residential and executive condominium (EC) developments is derived from the Government Land Sales (GLS) programme and Master Plan revisions (which affect en bloc sales from plot ratio increase or change of use), this component of the increase is very much policy-induced. For example, a desire to exact an increase in the population through immigration would require more housing. If population increases are to be accommodated, then increasing the GLS programme would be the induced policy action. However, the desire to house the increasing population starts to run counter to the cooling measures, the TDSR framework and the rule against developers not being able to lease out unsold units, which while it helps to achieve the objective of slowing down housing loan growth, also causes a constriction in supply.

Another component, “Others”, contributed about 5.7% of the gross housing loan growth. We believe this could be due to a combination of LTV growth, increased loan tenures and the ability of homeowners to remortgage the excess equity value of their properties. Resale loans contributed an estimated 1% to loan growth. For resale properties, we assume that all the sellers have loans that are half paid off and the buyers have taken up mortgages at the full LTV. It should be highlighted that the resale market is quite unlike its primary sale counterpart. This is because the seller of a property in the resale market would likely have an existing loan (we are assuming they all have loans). When the property gets sold, the buyer would take up another loan, while the seller’s loan will be dispatched. As a result, the net impact of the resale market adding to housing loan growth is very much reduced.

The “Others” component — if it is due to LTV growth and other aggressive lending practices — is quite easily managed once we have the TDSR framework in place. Therefore, from end-June 2013, we would expect this component to exhibit negative growth from the historical norm. In other words, post TDSR, the gradual increase in LTVs over time would have gone to 0% and possibly even entered the negative domain. If that is so, we have something that is already working to reduce loan growth. To see if this were true, we also broke down the sources of growth for housing loans for 2015 and found that the “Others” component had shrunk by 0.4%, showing that credit growth in this generally classified component has been arrested. We also found that estimated gross housing loan growth is much lower at 6.6%. The interesting takeaway from this is that loans growth has been fuelled mainly by volume increases in the primary market and understandably so. The GLS programme was ramped up in 2011 to 2013. Properties sold then are now in the process of being completed and loans are being progressively drawn down. There is nothing one can do about this and one just has to sit through 2016 and 2017 to allow this ghost of the past through.

In conclusion to the first part of this article, we can say that historically, price increases have a much smaller role to play in contributing to housing loan growth. Policies such as government land sales and master plan changes, on top of aggressive lending by financial institutions, were instead major causes of the increase. Also, resale market transactions contributed much less to housing loan growth. With the TDSR measures in place, we would find that loan growth from high-risk lending practices has been curtailed. What is now contributing to loan growth is the progressive drawdown of loans from primary sales from 2013. Given that the GLS programme has been scaled back significantly, we would expect loan growth to the primary sales market to start to moderate from 2017.

Advertisement

Therefore, are some of the measures (other than the TDSR) to suppress prices justified? Measures such as the Additional Buyer’s Stamp Duty (ABSD) and Seller’s Stamp Duty in their current tone are more effective at curtailing transaction volumes than bringing down prices (since prices came down more as a result of the TDSR). As a result of these two taxation measures, loan growth will slow. However, there is a double impact on decelerating loan growth because the GLS programme has also been scaled back in recent years. This brings us to the question whether these measures are entirely necessary (since GLS supply is coming off) in the current milieu? One of the biggest bugbears of these taxation measures is they are indiscriminate in nature, and affect both primary and resale transactions. While the GLS programme has been slowing, the stock of sold properties is increasing. Arresting transaction volumes of the latter will almost freeze up the real estate economy but do little to dampen loan growth. This is evident in Charts 2 and 3, which show that resale loans contribute little to housing loan growth. So, while we may experience a soft landing purely in terms of price, the effect of these measures causes the velocity of transactions to plummet, leading to a sharp correction in the private residential and EC economy.

Price increase possible without breaking the bank

The previous analysis sets the background for this section on whether we can have moderate loan growth alongside price increases without raising the level of risk to both households and lenders. As at 4Q2015, 20,607 private residential and EC units remain unsold. By constraining housing loans to a list of growth rates and LTVs, we can easily calculate whether the stock of unsold properties can be accommodated under various scenarios.

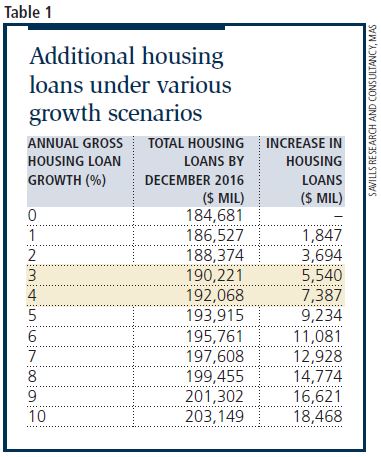

Column 3 in Table 1 shows the gross additional loans that can be disbursed under varying gross loan growth rates as shown in Column 1. Using a conservative limit of 4%, the additional loans that can be disbursed by this November top out at $7.4 billion. As we have not factored in loan repayments and retirements, the net loan growth rate will be lower and so, one can be more aggressive in the gross growth rate.

Using average prices for each housing type transacted in 2H2015, the total value of properties in the pipeline that remain unsold is about $27.18 billion (see Table 2).

From Table 1, we vary the LTVs by increments of 10% from 50% to 80%. This is shown in Table 3. Table 4 captures house price increases in a range of 0% to 5% from the beginning of 2016 to November. This house price increase is applied in Column 4 in Table 2 (Total value). This is then matched with Table 3 to determine which combination of LTV and price increase would exceed the limit set on housing loan growth.

Table 4 shows the total amount of loans under various house price increases. As an illustration, if a 3% price increase is tolerable, this works out to $28 billion of housing transactions in 2016. Comparing this with figures from Table 3, which shows the total value of housing transactions under various gross housing loan growth rate and LTVs, we can estimate the range of gross housing loan growth and LTV scenarios that will not exceed this.

Advertisement

In this exercise, we are using cumulative net loan growth. This includes loan repayments and other retirement of principal, the actual amount of loans that can be disbursed is higher. For example, if the amount of principal repaid is 2.1%, then to achieve a net cumulative loan growth of 3%, the amount of new loans is the combination of amount recently repaid and new loan growth.

To summarise, this means we can have a moderate price increase and comfortably absorb that with moderate cumulative net loan growth.

Referring to our example, we ask, “What if by end-2016, the total transacted value of properties remains at end-2015 levels but now we have a price rise of 3%; then how many types of primary sale properties can be accommodated with loan growth at 4% and the LTV capped at 60%?” In reality, it will not be a full disbursement because of the progressive payment schedule. Table 5 (see next page) shows that under these constraints, 9,686 units from the inventory of 20,607 unsold units (including ECs) can be transacted in 2016.

The last column of Table 5 shows the sensitivity of a $1 million increase or decrease of new loans on each housing type transacted. Obviously, the more expensive detached homes are less sensitive to additional loans allocated while ECs are the most sensitive. With this understanding, through affirmative action such as active reallocation of more new loans to, say, the housing types with the greatest sensitivity, we can help to move more stock in that category.

What this shows is that if house prices increase by an unalarming 3%, loan growth is still manageable. As mentioned earlier, since we are assuming there is no principal repayment of the existing loans in the system, the new loan growth of 4% is conservative. The estimated 9,686 units that can be accommodated by the additional loans are about 95% of the approximately 10,200 new sales transacted in 2015. Unfortunately, although prices can be afforded a raise, the supply of new homes will have to be restrained because Chart 3 shows primary sale loans are a major contributor to the increase of housing loans.

Conclusion

Market observers concerned with rising household indebtedness often link it to rapid housing loan growth and attribute it to the price factor. However, one of the significant contributors to housing loan growth is primary home sales; price has much less influence. To illustrate, say, a new property comes on stream with a value of $2 million. If the LTV is set at 60%, the loan quantum of $1.2 million immediately goes into the cumulative net loan books. For the price effect, even if it went up by 20%, the loan quantum would go up by a mere $240,000. It is clear the quantum of a loan taken for an incremental property supplied dwarfs the price effect.

It is important to understand this because while the cooling measures and TDSR seek to limit loan growth, these constraints square off against the need to increase the population. To accommodate 6.9 million or more people, additional housing has to be supplied, which then leads to more new housing loans. If the deposit base of the banking system does not rise to match this increase in supply, then the overall loans-to-deposit ratio for the housing sector will rise. This has now become a source of contention as to whether increasing the population for the good of the economy has such overwhelming benefits that we can overlook the negatives. If increasing the working population can lead to strains on the physical infrastructure aspect, so too can it strain our housing loan books.

On the fear of price increase, Table 5 shows that for 2016, one can still have moderate housing loan growth of 4% per annum with prices rising 3%. This can be done at new sales volume about 95% of 2015 levels. Nevertheless, this still does not bring back the liquidity to quench the thirst of the 29,626 salespersons in the property industry, the mortgage bankers, interior designers, renovation contractors and others in the industries supporting real estate. The answer to this is partially found in Charts 2 and 3, which show that because resale transactions contribute much less than primary home sales, we can increase the rate of shuffle without having a significant impact on housing loan growth. To illustrate, we use a simple two-party transaction function. Say, if both our houses are perfectly comparable in terms of physical attributes and we have the same amount of loan outstanding, then if you buy my house and I buy yours, what is the effect on housing loans? Zero. However, it is not without benefit to others as people in property sales, renovation contracting and conveyance, among others, will benefit from it.

Why is there a need to focus more on transaction volumes than prices? For one, price alone does not a real estate economy make. There has to be volume as well. Although prices had been perceived to have had a soft landing, the same cannot be said of transaction volumes, which had nosedived 61% from 2012 to 2015. In conclusion, at this juncture of our residential real estate supply and economic cycle, the case for adjusting the cooling measures is strong. While prices are experiencing a soft landing, the residential real estate economy is down very sharply. Concerns that any recalibration of measures may lead to a resurgence of household indebtedness levels can be allayed if the main function is redirected at increasing resale transactions.

Alan Cheong is head of research and consultancy at Savills Singapore. He can be reached at alan.cheong@savills.com.sg.

This article appeared in The Edge Property Pullout, Issue 714 (February 8, 2016) of The Edge Singapore.

https://www.edgeprop.sg/property-news/fret-not-about-house-price-increases-and-debts

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles