Eight confirmed list sites yielding 5,160 new residential units, the highest in 10 years

By Timothy Tay

/ EdgeProp Singapore |

A notable site on the Confirmed List is a 0.68ha site at Orchard Boulevard with the potential to house 270 residential units and 5,38 sq ft of commercial space. This site will have direct access to Orchard Boulevard MRT Station. (Map: EdgeProp Landlens)

A notable site on the Confirmed List is a 0.68ha site at Orchard Boulevard with the potential to house 270 residential units and 5,38 sq ft of commercial space. This site will have direct access to Orchard Boulevard MRT Station. (Map: EdgeProp Landlens)

Ask Buddy

Condo transactions with the highest profits in the past year

Condo projects with most unprofitable transactions

Condo projects with most profitable transactions

Compare price trend of HDB vs Condo vs Landed

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Condo projects with most unprofitable transactions

Condo projects with most profitable transactions

Compare price trend of HDB vs Condo vs Landed

Past Condo sale transactions

SINGAPORE (EDGEPROP) - The 2H2023 Government Land Sales (GLS) Programme will contain eight development sites on the confirmed list, which can collectively yield about 5,160 new private residential units, including 560 executive condominium (EC) units.

The supply of private housing in the 2H2023 GLS Programme is 26% more than what had been offered under the 1H2023 GLS Programme, which contained 4,090 new private residential units. This means that the government would inject approximately 9,250 units for development for 2023, which it says is the highest level in a decade.

The reserve list, containing sites that need to be triggered for tender, comprises six residential sites (including two EC sites), one commercial site, a white site, and a hotel site. These Reserve List sites could yield 3,430 private residential units (including 855 EC units), about 1 million sq ft of commercial space, and 530 hotel rooms. (Find Singapore commercial properties with our commercial directory)

Advertisement

Advertisement

Edmund Tie’s head of research and consultancy, Lam Chern Woon, observes that most of the residential sites on the confirmed and reserve lists are in the heartlands, with some exceptions such as the plots at Orchard Boulevard, Zion Road (Parcels A and B), Pine Grove (Parcel B) and Holland Drive. “The choice of the prime sites were carefully calibrated to ensure that supply is not excessive,” he says, adding that the government continues to adopt a ‘light touch’ on commercial and hotel supply, preferring to place the bulk of supply under the Reserve List.

Bump in supply to stabilise the housing market

In a June 21 press release, the Ministry of National Development said the latest GLS supply “will bring the total pipeline supply of private housing (including ECs) to about 63,500 units and cater to resilient demand.”

The ministry adds: “The increased confirmed list supply for 2H2023 will add to the existing pipeline supply to meet the population's housing needs. Specifically, it will bring the total pipeline supply of private housing (including ECs) to about 63,500 units, comprising 50,200 units with planning approval and 13,300 units from GLS sites and awarded en-bloc sites that have yet to be granted planning approval”. (See potential condos with en bloc calculator)

Based on submitted development plans, about 40,400 units are set to be completed between 2023 and 2025, doubling from 20,000 units completed between 2020 and 2022. “Releasing more land parcels can help assure buyers that there is sufficient private home supply, and the increase in home supply may help to moderate price increases and stabilise the market in the long run,” says Christine Sun, senior vice president of research and analytics at OrangeTee. She adds that many new land parcels are attractive, offering good housing options for future buyers.

“With the collective sales market staying anaemic, the government has stepped up its supply of land to meet the strong demand for housing,” says Lee Sze Teck, senior director of research at Huttons Asia. He adds: “The sites on the confirmed list will attract keen interest from developers. Many sites are either directly connected to an MRT station or within a short walk of an MRT station. Several are in new locations which have not seen any new supply for many years”.

‘Trophy project’

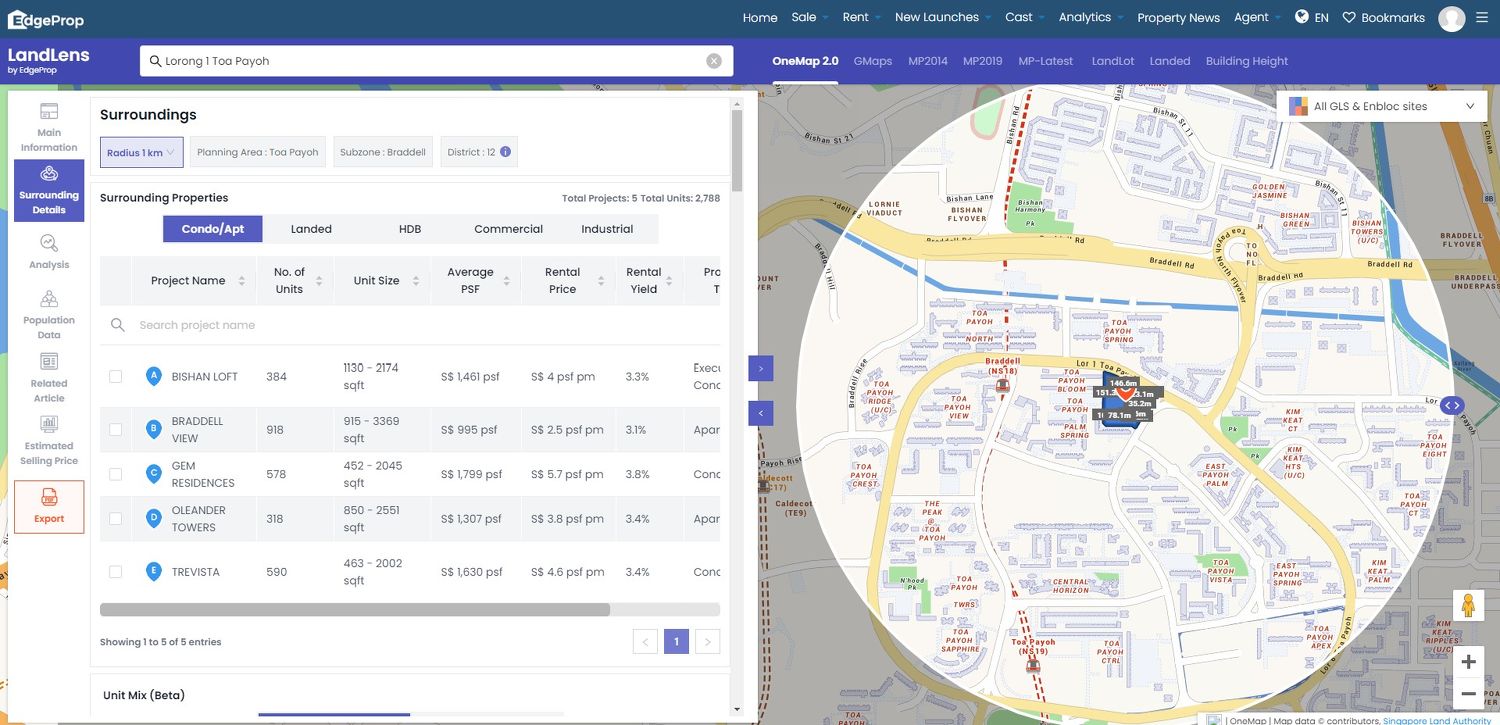

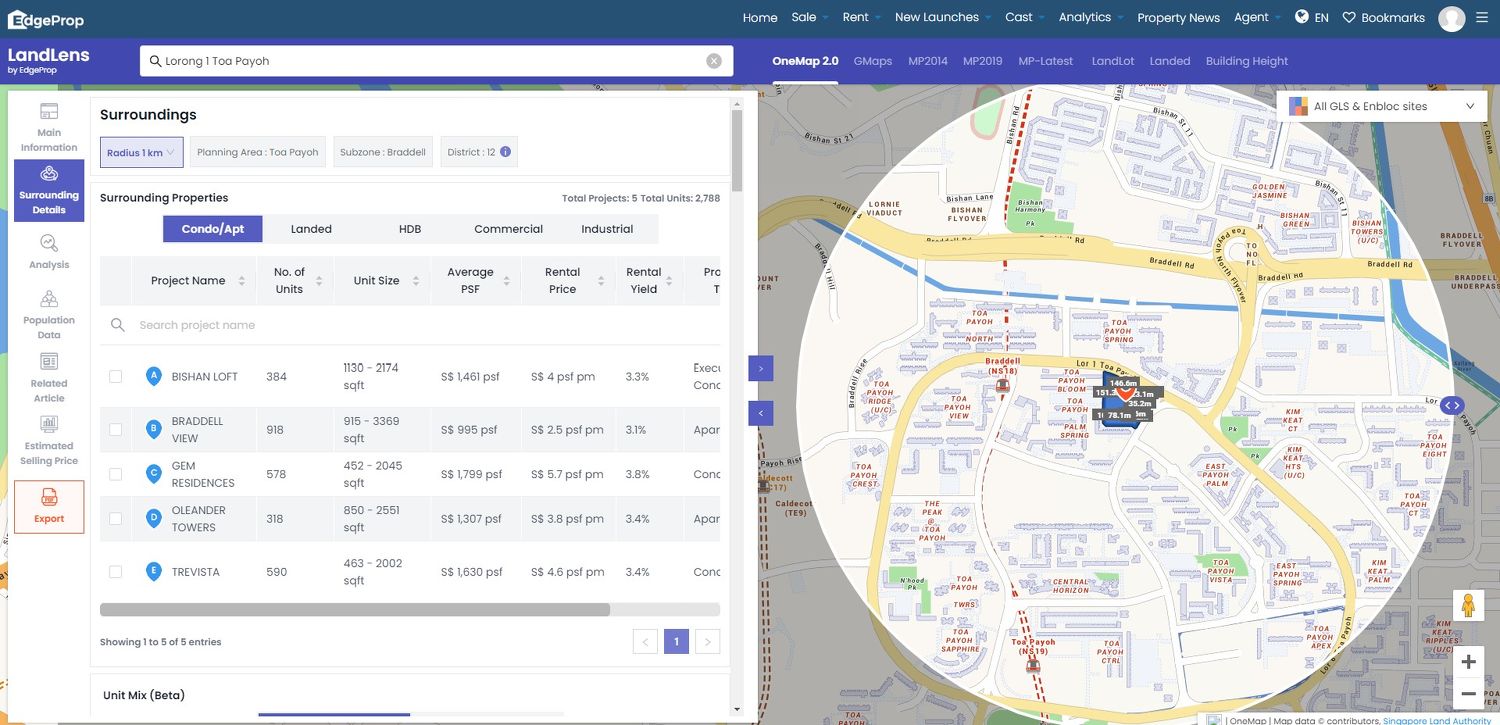

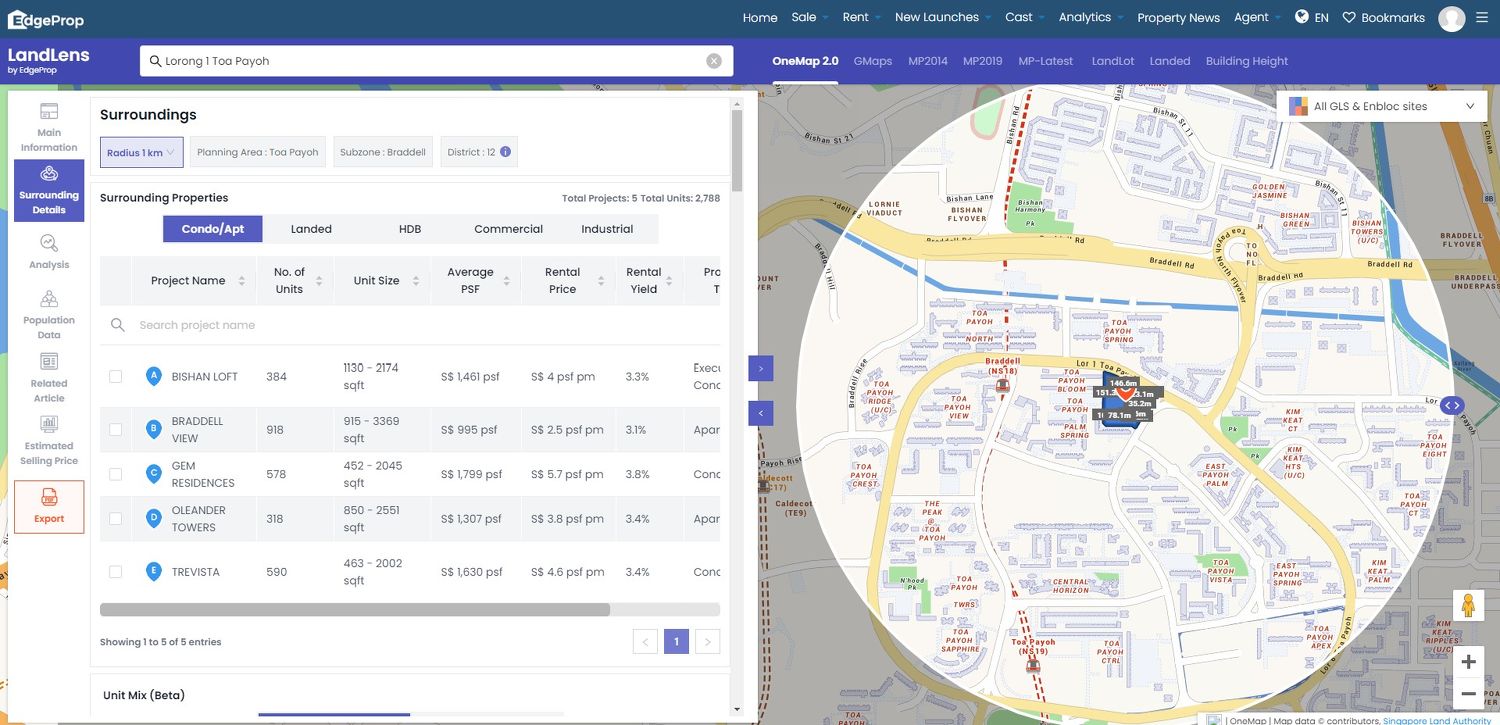

One site on the confirmed list is a 1.57-ha plot at Lorong 1 Toa Payoh, which could yield about 775 units. According to Lee, it has been about eight years since the government released a development site for a condo in Lorong 1 Toa Payoh.

Advertisement

Advertisement

The GLS site at Lorong 1 Toa Payoh. (Map: URA)

“With five-room flats at The Peak @ Toa Payoh exceeding $1 million and quite several recently MOP-ed flats exceeding $800,000, there is a sizeable pool of potential HDB upgraders,” he says, forecasting that the top bid for this site could be more than $1,200 psf ppr. (Find HDB flats for rent or sale with our Singapore HDB directory)

A 0.68ha site at Orchard Boulevard is also on the confirmed list, with the potential to house 270 residential units and 5,382 sq ft of commercial space. This site will have direct access to Orchard Boulevard MRT Station.

Sun describes the future project on this site as a potential ‘trophy project’ by developers, given its prime central location in Orchard and proximity to the Orchard Road shopping belt. “The area has not seen a new GLS site released for sale in the past five years. Thus, developer and buying interest will likely be healthy for this plot,” she says.

The new GLS site at Orchard Boulevard. (Map: URA)

The last GLS site released in this area was on Cuscaden Road, which SC Global developed into the luxury project Cuscaden Reserve. That site attracted nine bidders then, and the winning bid of $2,377 psf ppr was awarded in May 2018. “With the cooling measures crimping foreign demand, the unit mix, size, and quantum (of the future development) will have to cater more towards the local market. Nevertheless, it is still a very attractive site, and the top bid could be more than $1,500 psf ppr,” says Lee.

Two new residential development sites in the Springleaf area have also been featured. This neighbourhood has opened since the completion of the Thomson-East Coast Line last year. The confirmed list counts a 2.44ha site on Upper Thomson Road (Parcel A) that could yield 595 units and 21,520 sq ft of commercial space and a 3.2ha site on Upper Thomson Road (Parcel B) that could house 940 units.

A 1.51ha site with a relatively high plot ratio of 5.6 was also launched along Zion Road, and URA estimates that the site could yield 955 units and a total commercial space of 25,824 sq ft. This plot is directly connected to Havelock MRT Station on the Thomson-East Coast Line. “Mixed-use sites with a direct MRT connection are highly sought after by buyers as it offers superior convenience,” says Lee. “Homes on the higher floors will have towering views towards the south. It could see a top bid of more than $1,300 psf ppr."

Advertisement

Advertisement

The new GLS site at Zion Road. (Map: URA)

Neighbouring this land parcel is the former Jaik Kim Street GLS site which has been redeveloped into Riviere by Frasers Property. That GLS site attracted 10 bids, and the winning bid topped out at $1,732 psf ppr.

Another past GLS site is the land parcel at Irwell Bank Road, which has been developed into Irwell Hill Residences by City Developments. The site attracted seven bids at the time, with a winning bid of $1,515 psf ppr.

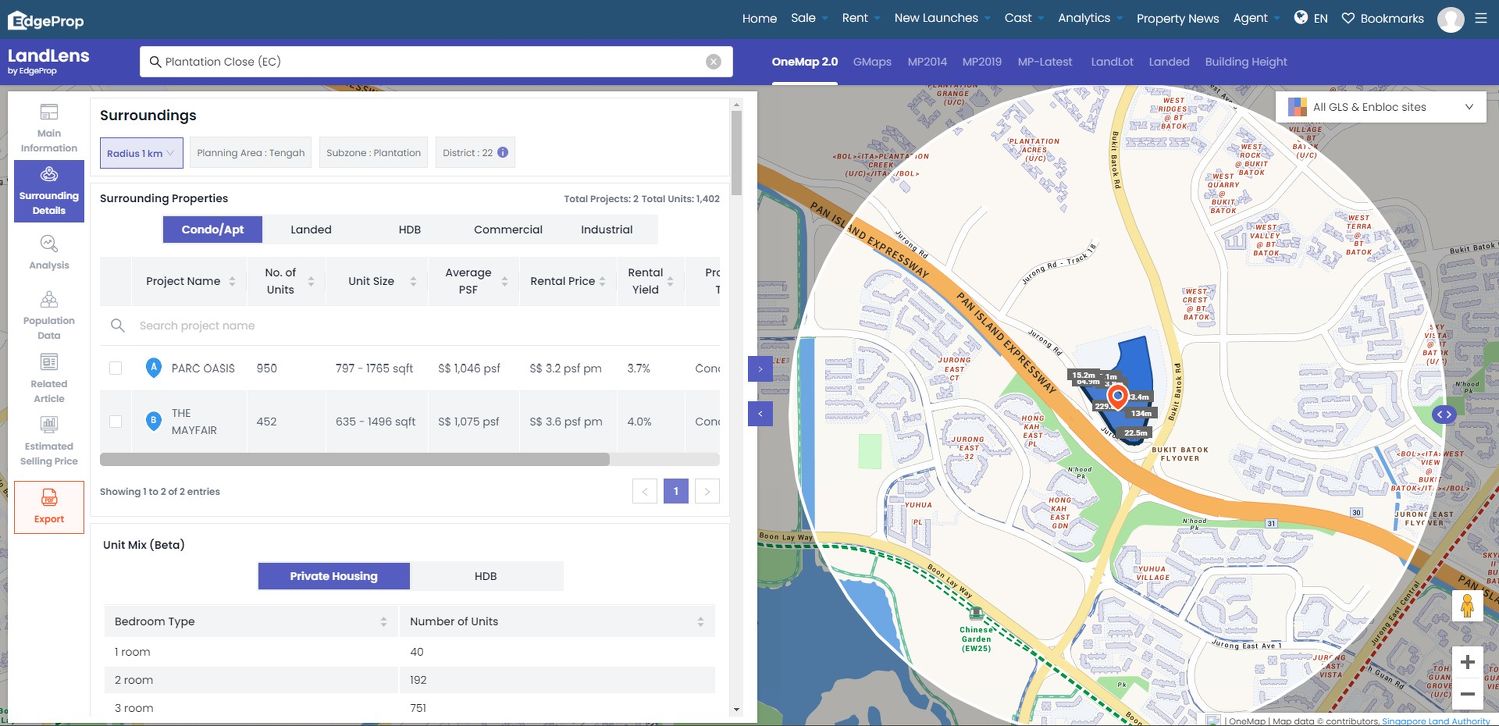

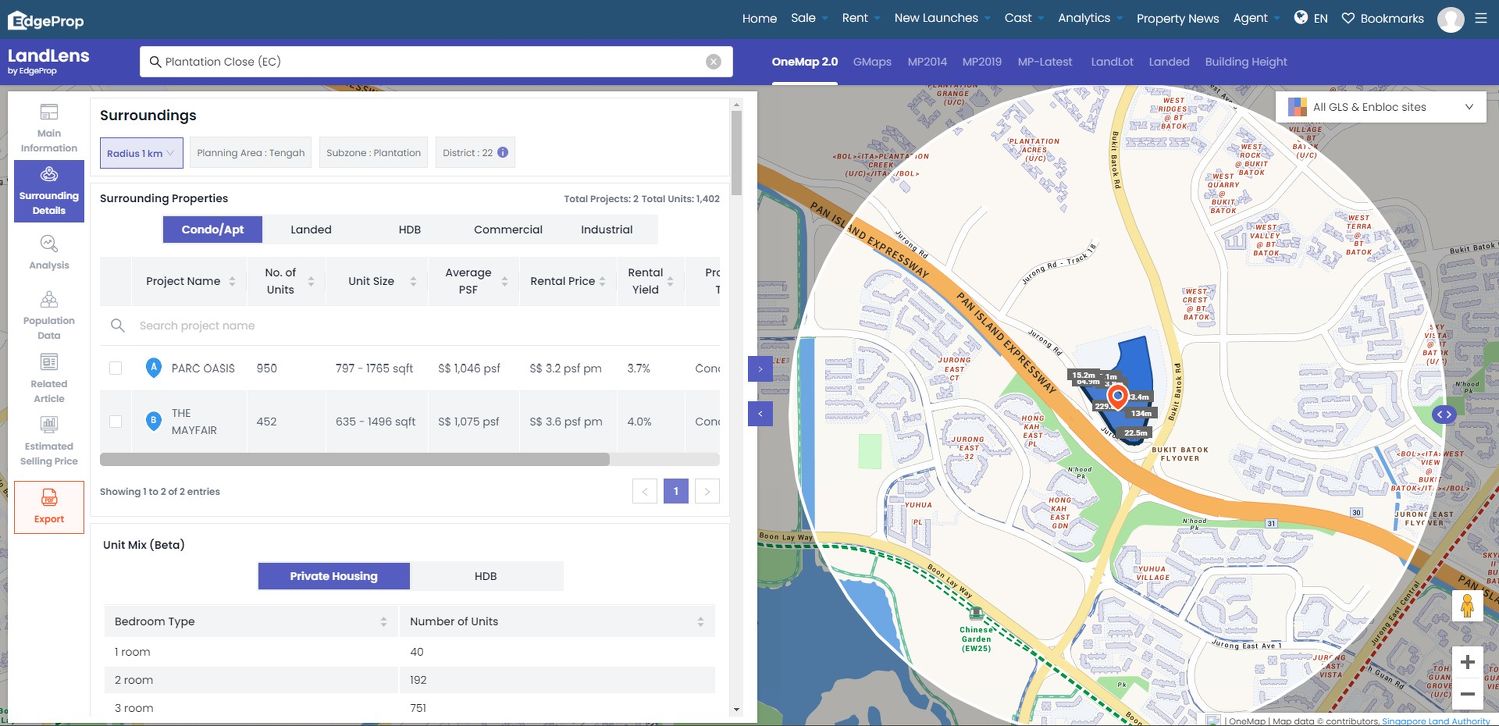

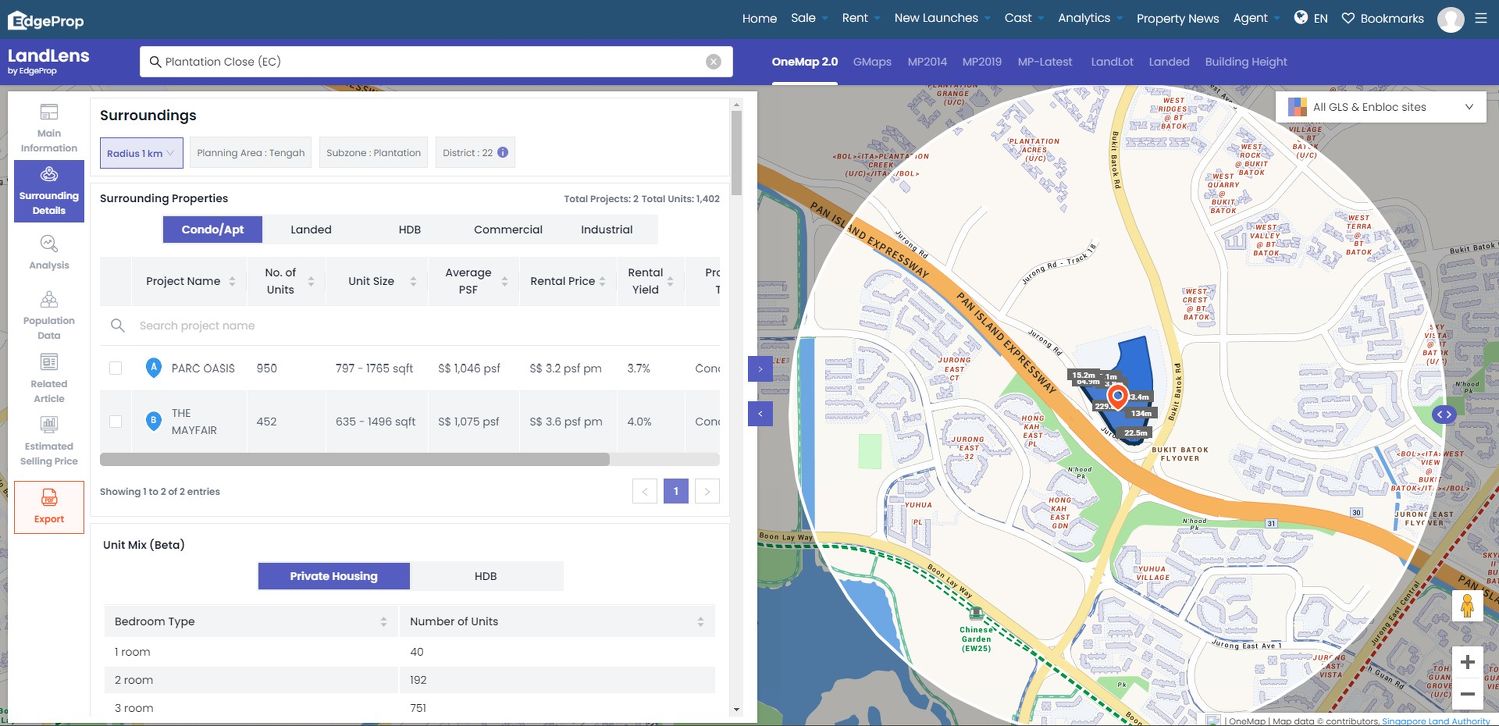

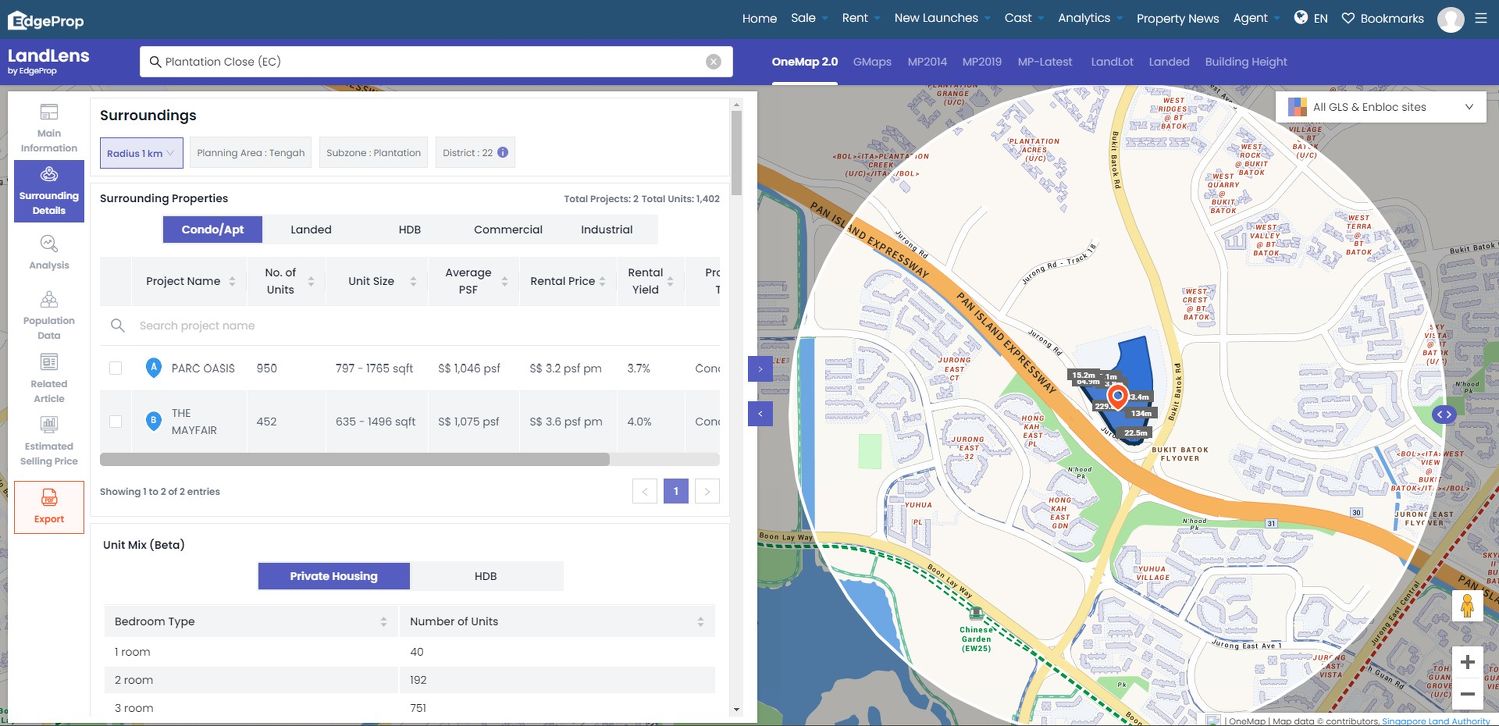

There is also one EC site on the confirmed list, a 2.01ha plot on Plantation Close in Tengah with the potential to yield 560 units. Lee says the release of this EC site is in response to the strong sales at recent EC launches like Copen Grand and Tenet. “Following the success of Copen Grand, developers may be keen to look at EC sites in Tengah to shore up their landbank. It could draw up to 8 developers and a top bid of more than $650 psf ppr.”

The EC site at Plantation Close. (Map: URA)

Office and hotel supply

On the Reserve List is a White site for a mixed-use development at Woodlands Avenue 2 and a short-term lease commercial site at Punggol Walk. These have been carried over from the 1H2023 Reserve List.

There is also a Hotel development site at River Valley Road which was also carried over from the 1H2023 Reserve List.

Check out the latest listings near Orchard Boulevard, Toa Payoh, Zion Road, Pine Grove, Holland Drive, Cuscaden Reserve, Riviere, Irwell Hill Residences, Orchard Boulevard MRT Station, Havelock MRT Station

Ask Buddy

Condo transactions with the highest profits in the past year

Condo projects with most unprofitable transactions

Condo projects with most profitable transactions

Compare price trend of HDB vs Condo vs Landed

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Condo projects with most unprofitable transactions

Condo projects with most profitable transactions

Compare price trend of HDB vs Condo vs Landed

Past Condo sale transactions

https://www.edgeprop.sg/property-news/eight-confirmed-list-sites-yielding-5160-new-residential-units-highest-10-years

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles